Transfering money to a loved one in the Philippines can be a complicated process. Banks often have high fees, limited hours, and complicated procedures, making sending money time-consuming and expensive.

Given the state of technology, where everyone has a supercomputer in their pocket, there should be a simpler way.

Now there is! Pomelo.

Instead of long waits, high fees, and inconvenient cash pickups, send a Pomelo card to your loved one and get them spending right away.

They use credit—you pay it off. It's that simple!

This article will walk you through the specifics of how Pomelo works, its benefits over traditional money transfers, and how to send a card to your loved ones in the Philippines.

Why Choose Pomelo?

With so many options out there for transferring money, you may be wondering why you should choose Pomelo. Here are a few reasons:

No Transfer Fees

One of the main benefits of using Pomelo is that there are no transfer fees. This is a stark contrast to other money transfer methods.

For instance, if you were to send $300 via a cash pickup service you'd be charged:

- $4.99 with Remitly

- $5.99 with Xoom

- $6.99 with Western Union

These fees may seem minimal at a glance but can accumulate significantly over time. With Pomelo, you completely avoid these costs.

You may wonder, how does Pomelo make money then? The answer is simple—from the merchants, not the consumers. Pomelo operates by charging the merchants whenever the card is used.

By eliminating transfer fees, Pomelo allows you to save money and ensure that your loved ones receive every penny sent to them. This can make a huge difference for families relying on remittances.

No Need for a Cash-Out Network

Traditional money transfer services require receivers to physically go to a designated location to collect the money. Not only is this process time-consuming, it can also be particularly inconvenient for the receiver, especially for those living in remote or rural areas, or those without transportation.

With Pomelo, funds are immediately available on the card for use once the sender pays it off. There's no need for your loved ones to travel anywhere. They can use the card directly at any establishment that accepts Mastercard, Google Pay or Apple Pay.

24/7 Availability

Unlike banks that operate within set hours, online money transfer with Pomelo is available around the clock. You don't have to schedule or delay sending money because of bank operating hours or public holidays.

This 24/7 availability can be critical in emergency situations where the funds need to be available urgently. It also provides convenience for those who may be in different time zones or have different schedules. With Pomelo, you have control over your finances at all times.

Send Now, Pay Later

Sometimes, you might want to send money to your family right away, but you're waiting for the next paycheck to come through. With Pomelo, this isn't a problem. You can send the money now, and pay for it later.

The Pomelo card works as a charge card—as long as the balance is paid off at the end of the month, there’s no extra fee. This means that your loved ones don't have to wait for the funds, and you can pay off the balance at your own pace. This kind of flexibility can be especially helpful for managing finances efficiently.

How Pomelo Works

Pomelo is designed to be straightforward and easy to use. Here's a step-by-step guide on how it works:

Step 1: Apply

The application process for Pomelo is simple. You need to be 18 years or older and have a Social Security Number (SSN). Depending on your credit, you might also be required to link a bank account or supply a security deposit.

Step 2: Invite

Once your account is set up, you can invite up to three authorized cardholders in the Philippines. They will need a smartphone and an accepted form of ID. This feature can be extremely useful if you regularly send money to multiple family members or loved ones across the country.

Step 3: Spend

After the application process, custom Pomelo cards for your authorized cardholders should arrive in 10 days or less. As soon as the cards arrive, they can start using them—there's no need to wait for the funds to become available.

You can then pay off the balance on a monthly basis, offering you complete control over your finances. It's a worry-free and easy-to-use service, built for your convenience and peace of mind.

User-Friendly Interface and Experience

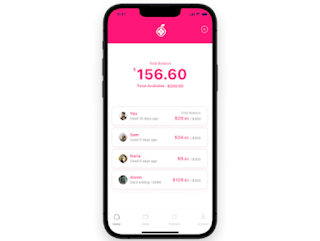

The Pomelo App is specifically designed to give you an intuitive and user-friendly experience, empowering you with increased control over your finances.

It includes things like:

- Instant Money Transfer: Send money instantly, no waiting around for bank hours or dealing with transfer delays.

- Budgeting: Allocate budgets to each cardholder, helping in better financial planning and fund distribution.

- Transaction Tracker: Track all transactions in real time for full visibility and manage your monthly budget more effectively.

- Payment History: A detailed record of all transactions is available, providing complete transparency on your money movement.

- Autopay: Set up automatic payments to avoid missed deadlines and late fees. This is perfect for those with busy schedules or prefer a set-it-and-forget-it approach.

Overall, the Pomelo App makes managing your finances and sending money to your loved ones in the Philippines a breeze. It's a touch of convenience in the palm of your hands.

Benefits of Using Pomelo

Pomelo offers several incredible benefits to its users. Here are a few:

Affordability and Cost Savings

First and foremost, Pomelo offers a cost-effective way to send money to your loved ones in the Philippines. With no transfer fees and competitive exchange rates, you can save a considerable amount compared to traditional money transfer methods.

Enhanced Security Measures

When it comes to financial transactions, security is a top concern. Pomelo uses advanced security measures to ensure that every transaction is safe, protecting your personal information and your money at all times.

Users can also easily monitor transactions using the Pomelo app, adding an additional layer of security and transparency.

Customer Support and Assistance

Pomelo offers 24/7 customer support to address any queries or issues you may face. A dedicated team of customer service representatives are committed to ensuring that your money transfer experience is as smooth and hassle-free as possible.

Final Thoughts

Sending money to your loved ones in the Philippines shouldn't be a tedious or expensive task, and with Pomelo, it no longer has to be.

It's a unique and innovative solution that combines convenience, affordability, security, and superior customer service, making the process of money transfer as straightforward as possible.

Give Pomelo a try—experience the difference that a truly hassle-free money transfer service can make.

Tags

General Topics